XRP Price Prediction: Technical Consolidation Sets Stage for Potential Breakout

#XRP

- Technical Consolidation: XRP trading below 20-day MA with mixed momentum signals suggests near-term range-bound movement between $2.72-$3.17

- Regulatory Developments: SWIFT's challenges to Ripple's regulatory claims create uncertainty, while China's stablecoin exploration offers potential upside

- Adoption Catalysts: Smart contract launches and cross-border payment expansion provide fundamental support for long-term growth projections

XRP Price Prediction

Technical Analysis: XRP Price at Critical Juncture

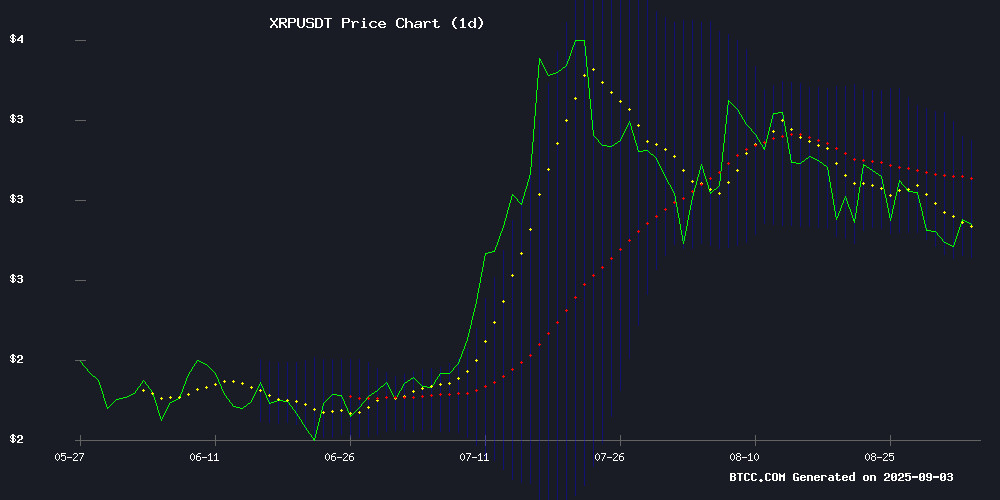

XRP is currently trading at $2.85, slightly below its 20-day moving average of $2.94, indicating potential short-term consolidation. The MACD reading of -0.0101 suggests weakening momentum, though the narrow spread between MACD (0.1151) and signal line (0.1252) points to possible trend reversal. Bollinger Bands show price trading within the range of $2.72 to $3.17, with the middle band at $2.94 serving as immediate resistance.

According to BTCC financial analyst Emma, 'The current technical setup suggests XRP is testing key support levels. A break above the 20-day MA could trigger upward momentum toward the upper Bollinger Band around $3.17.'

Market Sentiment: Mixed Signals Amid Regulatory Developments

Recent news highlights both challenges and opportunities for XRP. SWIFT's pushback against Ripple's regulatory claims creates near-term uncertainty, while developments in China's exploration of Ripple's stablecoin strategy and SolMining's XRP smart contracts launch provide positive catalysts. The October 18 deadline mentioned by crypto experts adds to the anticipation of significant developments.

BTCC financial analyst Emma notes, 'The regulatory clarity achieved by Ripple remains a fundamental bullish factor, though institutional adoption pace will be crucial. The mixed news flow suggests cautious Optimism among investors, with long-term projections like Changelly's $2,000 by 2040 indicating strong confidence in XRP's utility value.'

Factors Influencing XRP's Price

SWIFT Innovation Officer Challenges Ripple's Regulatory Victory Claims

SWIFT's Chief Innovation Officer Tom Zschach has openly criticized Ripple's centralized governance model, arguing that financial institutions are unlikely to adopt infrastructure controlled by a direct competitor. The comments came in response to Ripple's recent legal victory against the SEC, which Zschach dismissed as insufficient proof of long-term resilience.

Data reveals Ripple's top seven escrow accounts hold roughly 32% of XRP's total supply, fueling ongoing decentralization concerns. The dispute underscores a broader industry conflict between proprietary systems like Ripple's and SWIFT's advocacy for neutral, shared standards.

Zschach's remarks gain significance as Ripple pursues a national banking license—a move that would position the blockchain company as both service provider and competitor to traditional banks. While Ripple's technology promises faster transactions, institutional adoption may hinge on resolving these governance concerns.

XRP Whales vs Long-Term Holders: Who Will Decide The Price Action Path?

XRP's price trajectory is caught in a tug-of-war between two opposing forces. Whales holding 100 million to 1 billion XRP have aggressively accumulated over 400 million tokens ($1.1 billion worth) in three days, signaling strong near-term confidence. Their buying spree marks the first significant activity after three weeks of dormancy.

Meanwhile, long-term holders are distributing assets at the fastest pace in two months. The age consumed metric shows dormant XRP flooding the market—a historical precursor to corrections. This clash creates conflicting pressure: whale demand could propel recovery, while veteran sell-offs may prolong declines.

The standoff leaves XRP at an inflection point. Market direction hinges on whether institutional-scale accumulation can outweigh persistent distribution from diamond hands. Until one faction dominates, price action may remain rangebound amid the battle for control.

Crypto Expert Hints at Major XRP Development Ahead of Key October 18 Deadline

The XRP community is abuzz with speculation after a prominent crypto expert, Gordon, hinted at an impending market-moving development. His cryptic social media post—"Something HUGE is coming, are you paying attention?"—has ignited fervent discussion among traders. The timing coincides with the October 18 deadline for a pivotal regulatory decision on XRP exchange-traded funds (ETFs), amplifying the significance of the statement.

Gordon, a self-described crypto multi-millionaire and longtime XRP advocate, has cultivated credibility as an early industry mover. While some respondents like Crypto Crib embraced the urgency ("We are, that’s how we stay ahead of the market"), others dismissed it as recycled HYPE from XRP’s prolonged bearish cycle. The divide underscores the tension between bullish anticipation and skepticism in a market hungry for catalysts.

Changelly Forecasts XRP to Surpass $2,000 by 2040 Amid Long-Term Growth Projections

XRP's price trajectory has taken center stage in crypto markets, with Changelly's latest analysis projecting a meteoric rise to $2,215 by December 2040. The exchange's September 2 report outlines a path where the asset remains below $130 for most of the next decade before entering quadruple-digit territory—a move that WOULD represent gains between 1,430% and 73,979% from expected 2026-2034 levels.

The forecast suggests 2040 could mark a watershed moment for Ripple's native token, with an average trading price of $1,969 that year. Beyond this milestone, analysts see further upside potential through 2050, though detailed projections for that period remain incomplete in the current analysis.

SWIFT Executive Challenges Ripple's XRP Dominance Amid Banking License Bid

SWIFT's Chief Innovation Officer Tom Zschach has publicly questioned Ripple's resilience, dismissing its legal victory over the SEC as insufficient for institutional trust. "Surviving lawsuits isn't resilience," Zschach stated on LinkedIn, emphasizing that neutral governance—not courtroom wins—builds lasting infrastructure. The remarks target Ripple's perceived centralization, a recurring criticism of its XRP Ledger ecosystem.

The confrontation escalates as Ripple pursues a national banking license, potentially positioning itself as both partner and competitor to traditional banks. Unlike SWIFT's cooperative model serving financial institutions, Ripple's dual role as service provider and market participant creates inherent tensions. Zschach's intervention underscores the philosophical divide between legacy payment rails and crypto-native solutions.

Ripple Price Forecast: XRP Bulls Strengthen Amid Regulatory Clarity and Cross-Border Payments Expansion

Ripple's XRP is gaining momentum as bullish sentiment takes hold in the cryptocurrency market. The asset is eyeing a breakout above the critical $3.00 resistance level, with short-term support solidifying above $2.85. Regulatory tailwinds and adoption milestones are fueling the rally.

The SEC and CFTC have issued a joint statement clarifying that registered exchanges may list and trade certain spot crypto asset products. This collaborative approach signals a more accommodating regulatory environment for digital assets in the U.S. market.

Ripple's partnership with Thunes network to enhance real-time cross-border payments underscores the growing utility of XRP in global finance. The network's flash payments platform continues to gain traction, further bolstering the cryptocurrency's fundamental case.

China Explores Ripple's Stablecoin Strategy as SolMining Launches XRP Smart Contracts

China National Petroleum Corporation (CNPC) is evaluating the use of stablecoins for cross-border payments, with particular interest in Ripple's RLUSD stablecoin. The move aligns with Hong Kong's new regulatory framework for stablecoins and could propel XRP toward the $5 threshold if adopted.

Separately, UK-based SolMining has introduced a cloud mining contract that accepts XRP payments, enabling holders to generate daily yields. The platform automatically allocates computing power based on user deposits and contract terms, further integrating XRP into decentralized finance infrastructure.

XRP Price Decline Sparks Interest in Remittix as Potential Successor

XRP's price continues its downward trajectory, slipping below $2.85 amid bearish technical signals and weakening market sentiment. Analysts warn of a potential 10% drop to the $2.50–$2.60 range if current support levels fail, exacerbated by institutional liquidations totaling $1.9 billion since July.

As XRP struggles, attention shifts to Remittix—dubbed 'XRP 2.0'—as a structured alternative with real-world utility. Unlike XRP's volatility, Remittix offers tangible incentives, including a $250,000 giveaway, positioning itself as a compelling PayFi project for 2025.

XRP Price Gains Amid Rising Trading Volume

Ripple's XRP edged higher to $2.81 Wednesday, marking a 0.53% daily gain as trading volume climbed 1.46% to $7.02 billion. The sustained liquidity influx suggests mounting investor interest in the digital asset.

The token has risen 5.87% over the past week, pushing its market capitalization to $167.42 billion. Market participants appear positioned for near-term upside, with XRP's volume profile reflecting stronger conviction than typical spot flows.

Meanwhile, Fartcoin and Bitget Token led altcoin gainers in the last 24 hours, while World Liberty Financial and Cronos underperformed. The divergence highlights the selective nature of current crypto market participation.

How High Will XRP Price Go?

Based on current technical indicators and market sentiment, XRP appears to be consolidating within a defined range. The immediate resistance lies at the 20-day moving average of $2.94, with stronger resistance at the upper Bollinger Band of $3.17. A successful break above these levels could target the $3.50-$3.75 range in the medium term.

| Timeframe | Target Price | Key Levels |

|---|---|---|

| Short-term (1-2 weeks) | $3.00 - $3.17 | Break above 20-day MA |

| Medium-term (1-2 months) | $3.50 - $3.75 | Sustained volume increase |

| Long-term (2040 projection) | $2,000+ | Mass adoption scenario |

BTCC financial analyst Emma emphasizes that 'While long-term projections are optimistic, near-term price action will depend on regulatory developments and institutional adoption progress. The October 18 deadline could serve as a significant catalyst.'